For decades, the entire financial world has been looking after the United States. The American economy is the strongest; the stock market is the largest; the dollar is the most needed. Unfortunately, the unipolar world does not accelerate development, but slows it down. The interesting thing is that the pandemic helped to trigger the mechanism of its destruction. China will surely overtake the US, European stocks and bonds will outdo their American counterparts, and the share of greenback in gold and currency reserves, international settlements and conversion operations will decrease. All this makes the long-term outlook for EUR/USD “bullish”.To get more news about WikiFX, you can visit wikifx news official website.

According to USB, China's economy will grow by 2.5% in 2020. Taking into account the sinking of the American GDP this year and the slower recovery in 2021-2022, China will be able to overtake the United States in the second half of the 20s. This is a very good news for the export-oriented eurozone. Of course, Washington doesn't like this and is organizing a commercial battle, shutting the Chinese consulate in Houston, in addition to the breakup of diplomatic relations, but the process cannot be stopped!

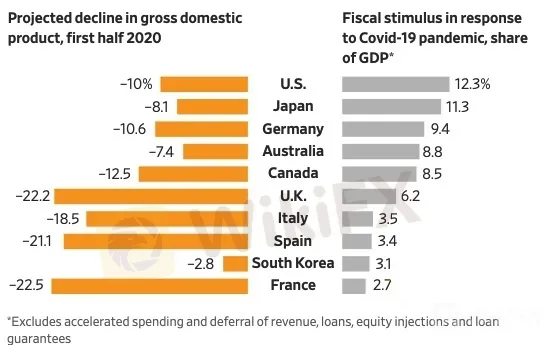

The American economy now resembles a steroid-pumped athlete. All this strong data on retail sales and other indicators against the backdrop of the labor market disaster is a direct result of fiscal and monetary stimulus, which is much greater than that in other developed countries. But there is a fierce debate over the new aid package between Republicans and Democrats, and when the bunch of money from the Fed starts looking for places to apply, the US dollar feels extremely bad.

The S&P 500 stocks have a P/E ratio at their highest level since the dot-com crisis. The bubble burst lately, and who can guarantee that this wont happen again? US Treasury yields are hovering near record lows, and the market is clearly overbought. But once rates rise, the Fed will face financial repression. For a long time, investors had no alternatives, but after the EU approved the Franco-German proposal, they appeared.

The project is not in vain called a milestone in European history and is compared with the proposal of the American Treasury Secretary Alexander Hamilton, who proposed the idea of buying state debts at the end of the 18th century. European Commission bonds are an obligation of the EU itself, and not of its members. The bonds can be acquired by the ECB, which practically eliminates the risk of default. The market has received a reliable asset competitive with Treasuries. In addition, it received a very attractive asset in the form of bonds of the peripheral countries of the euro zone, which is competitive with the debt obligations of developing countries. These countries have reduced their loan costs by 5,510 bps since the beginning of 2019, which makes their bonds less attractive.